New York Deferred Compensation

Human Resources > State Requirements > NY > System Settings Maintenance

Human Resources > State Requirements > NY > Deferred Compensation List

The ability to report deferred compensation has been added to the New York State Requirements menu.

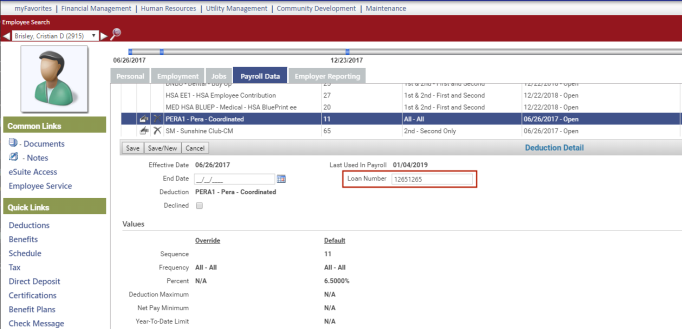

To let you set up deductions as deferred comp loan payments, a ![]() Loan Number field has been added to the Deduction Detail section of Workforce Administration.

Loan Number field has been added to the Deduction Detail section of Workforce Administration.

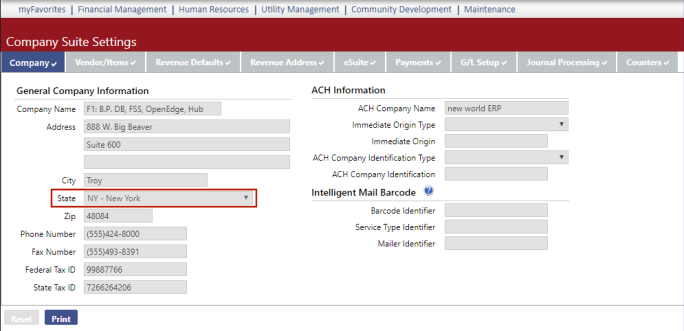

This field appears in Deduction Detail only when the ![]() State field in Company Suite Settings is set to NY.

State field in Company Suite Settings is set to NY.

If a deduction has a Loan Number on it, the amount of the deduction shows in the Loan Payment column of the New York Deferred Compensation file. If the Loan Number field is empty, the deduction amount shows in the Contribution column.

This new field allows multiple deductions to be set up for multiple loan numbers. Multiple loan numbers also may be set up through the Create Event function on a deduction.

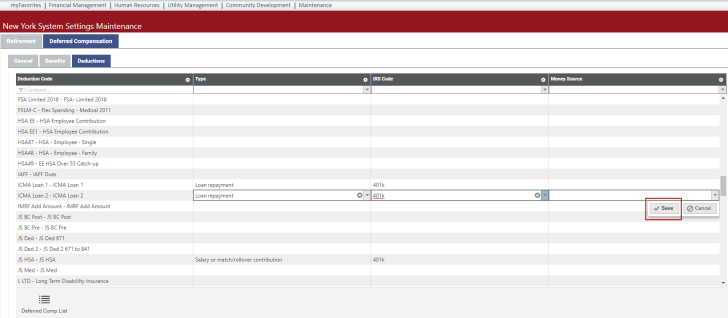

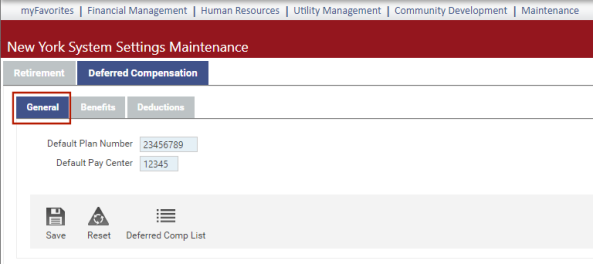

Human Resources > State Requirements > NY > System Settings Maintenance

A Deferred Compensation tab has been added to the New York System Settings Maintenance page. This tab contains three sub-tabs: General, Benefits and Deductions.

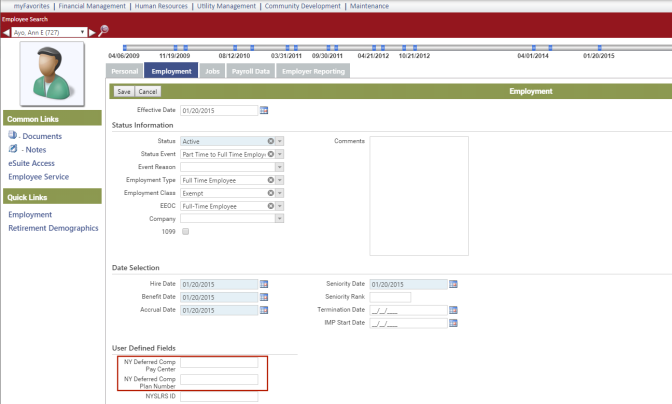

Default Plan Number and Default Pay Center are user-defined fields (UDFs) that appear on the ![]() Employment tab in Workforce Administration.

Employment tab in Workforce Administration.

By default, deferred comp data is created for the plan number and pay center identified on the New York System Settings Maintenance page but will be overridden for any employee who has a different plan number or pay center identified in Workforce.

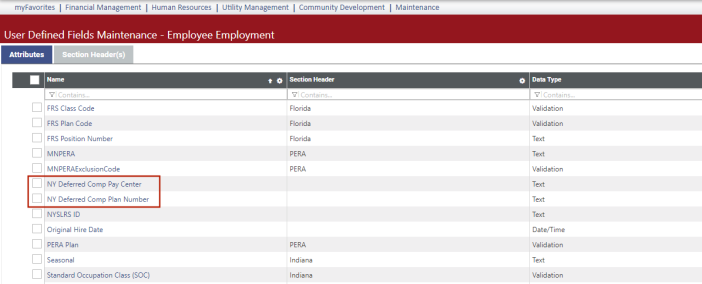

The Default Plan Number and Default Pay Center UDFs already have been set up for you on the ![]() User-Defined Fields Maintenance-Employee Employment page.

User-Defined Fields Maintenance-Employee Employment page.

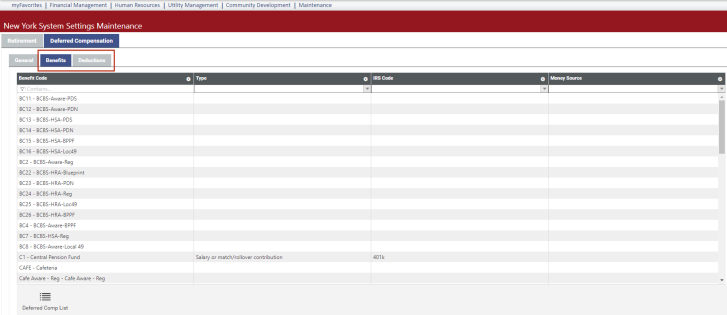

Use the Benefits and Deductions tabs to map benefit and deduction codes to the appropriate contribution type codes, IRS codes and money sources. Contribution types are regular contributions and loan repayments. Money sources are available for non-loans only. Money source descriptions appear on the drop-down; their corresponding codes appear in the transmittal file.

To save each selection, click outside the cell, or click the ![]() Save button.

Save button.

The selections available in the drop-downs come from the following validation sets:

| Drop-down | Validation Set |

|---|---|

| Type | 627 New York Deferred Comp Type |

| IRS Code | 628 New York Deferred Comp IRS Code |

| Money Source | 629 New York Deferred Comp Money Source |

Note: Validation sets already have been set up for you at Maintenance > New World ERP Suite > System > Validation Sets > Validation Set List.

If you select a code by mistake, click the X on the right side of the cell to remove it from the cell.

To navigate back and forth from the system settings page to the New York Deferred Comp List page while performing setup and running reports, use the Deferred Comp List button  on the system settings page and the Settings button

on the system settings page and the Settings button  on the New York Deferred Comp List page.

on the New York Deferred Comp List page.

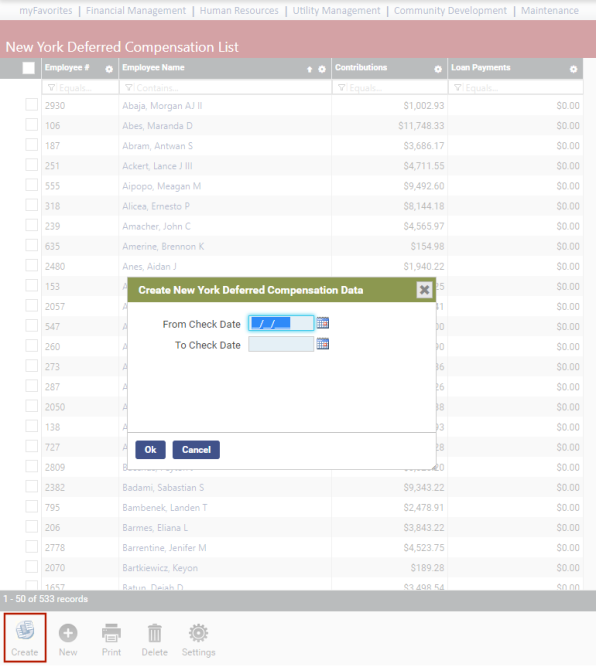

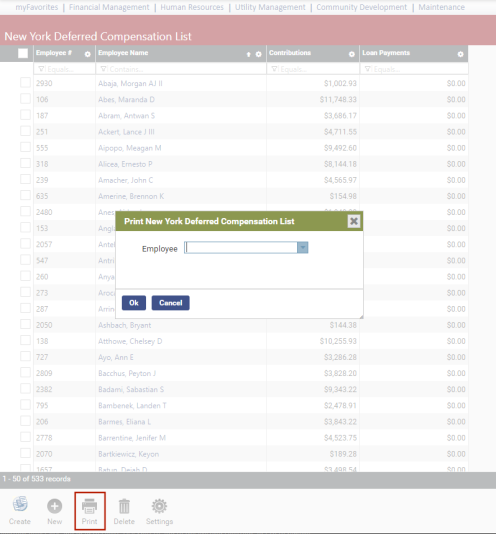

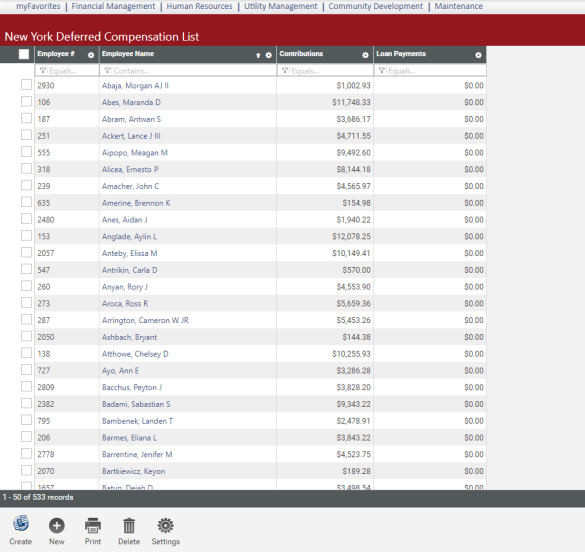

The ![]() New York Deferred Compensation List has been added to the NY State Requirements menu. After you have completed the setup, use this page to create, edit and report the deferred comp data.

New York Deferred Compensation List has been added to the NY State Requirements menu. After you have completed the setup, use this page to create, edit and report the deferred comp data.

The Create button on the New York Deferred Compensation List page opens the ![]() Create New York Deferred Compensation Data dialog.

Create New York Deferred Compensation Data dialog.

After selecting the range of check dates within which to report deferred comp data, click Ok. The grid on the New York Deferred Compensation List page reloads with the data that is available for the New York Deferred Compensation Report and transmittal file. You may review and modify this data before transmitting it to the state.

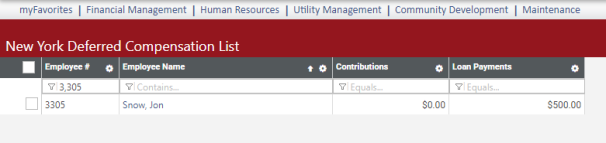

The grid on the New York Deferred Compensation List page contains employee contributions and loan payments. If an employee has a loan number on a deduction, the deduction amount shows in the Loan Payments column.

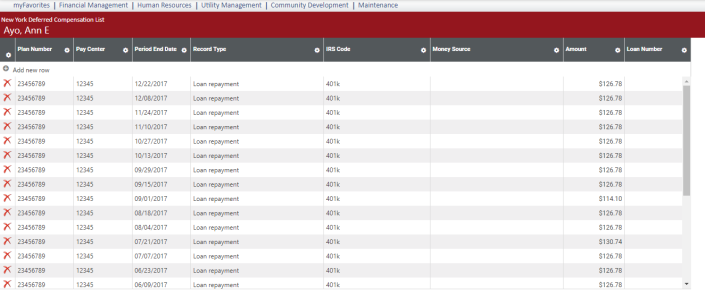

Click an Employee Name to view a ![]() grid of the contribution details for the employee.

grid of the contribution details for the employee.

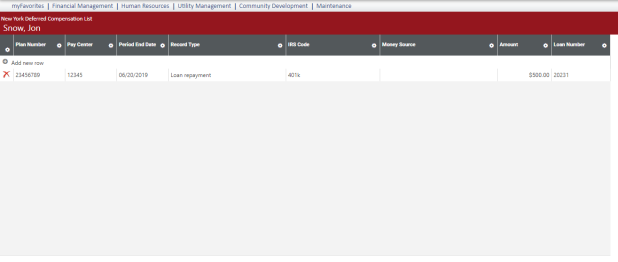

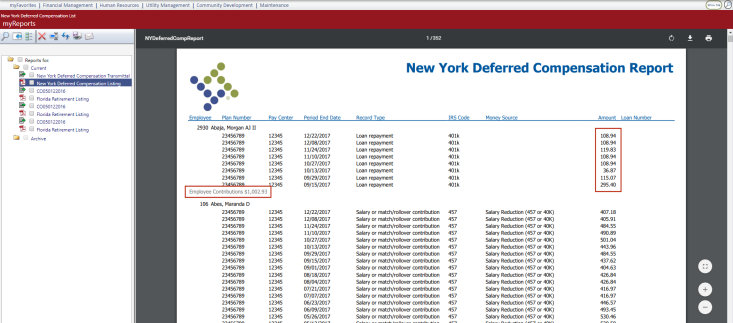

For each contribution, the grid contains the plan number and pay center, period end date of the batch selected, record type, IRS code, money source, contribution amount and loan number. The IRS code and money source come from New York System Settings Maintenance.

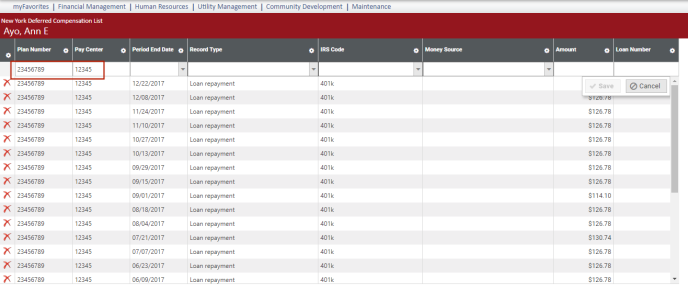

When you add a row to the grid, the ![]() Plan Number and Pay Center are populated automatically from system settings or the Employment tab in Workforce.

Plan Number and Pay Center are populated automatically from system settings or the Employment tab in Workforce.

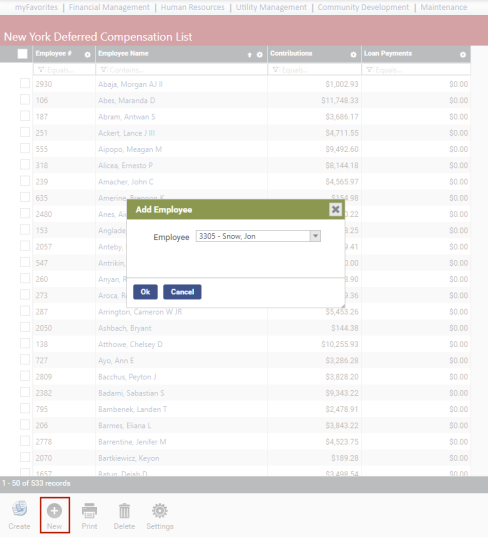

To add an employee to the deferred comp list, click the New button. The ![]() Add Employee dialog opens.

Add Employee dialog opens.

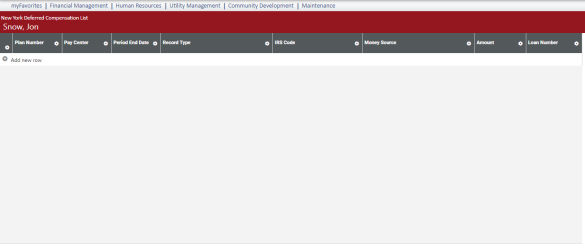

Select an employee and click Ok. The ![]() employee's deferred comp page appears.

employee's deferred comp page appears.

To add information, double-click Add new row. The Plan Number and Pay Center for the employee are loaded automatically. Fill in the appropriate cells and click outside the row, or click Save. (![]() View completed row.)

View completed row.)

Navigate back to the New York Deferred Compensation List page, where you will find the ![]() employee in the grid:

employee in the grid:

To navigate back and forth from the New York Deferred Compensation List page to system settings, use the Settings button  on this page and the Deferred Comp List button

on this page and the Deferred Comp List button  on the system settings page.

on the system settings page.

The Print button opens a ![]() Print New York Deferred Compensation dialog containing an Employee field.

Print New York Deferred Compensation dialog containing an Employee field.

You may run the report for a selected employee or leave the field blank to run it for all employees in the deferred comp group.

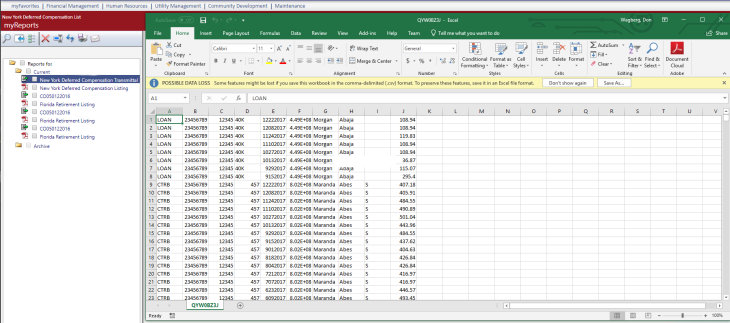

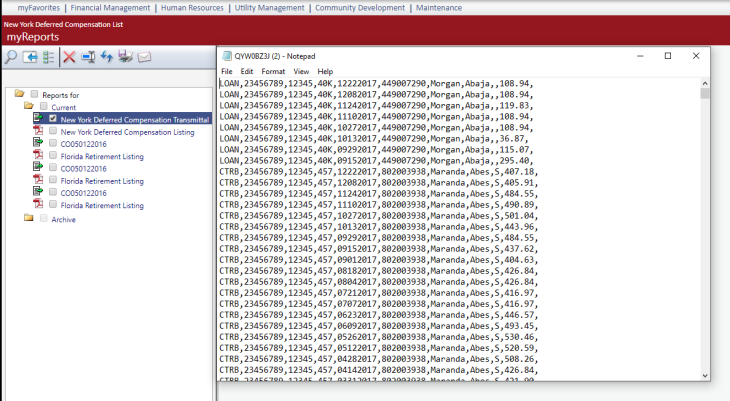

Click Ok. The New York Deferred Compensation Report and transmittal file are generated and sent to myReports.